Sample attendee list

In Association with Beacon-TPD

March 2025: Why are DACs attractive to pharma?

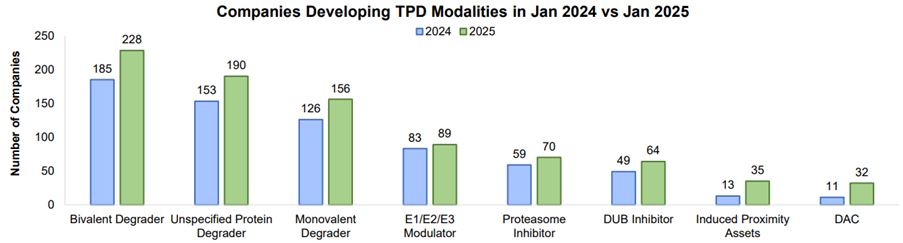

Between January 2024 and 2025, all development programs increased across all TPD modalities, most significantly in induced proximity and DACs, increasing by 169% and 190% as induced proximity biotech launched and biotech added DACs technology to their pipeline.

Exploring the Potential of DACs:

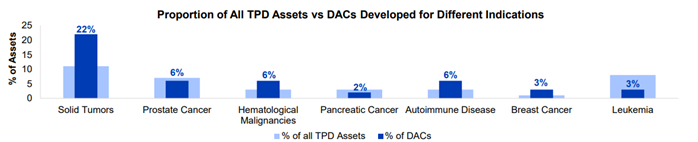

The graph below demonstrates the percentage of DACs developed against different indications versus the percentage of all TPD assets developed for those indications.

Solid tumors are the indication for which most DACs (22%) are being developed. This is significantly greater than the overall landscape, where only 11% of TPD drugs target solid tumors. This may be because, in comparison to traditional degraders, DACs can offer greater selectivity by delivering degraders directly to the specific tumor cell of interest.

Interestingly, 6% of DACs are being developed for autoimmune disease, compared to just 3% of the broader landscape. There are currently no approved TPD-based drugs or ADCs for autoimmune disease. By targeting specific proteins involved in the autoimmune response, DACs can provide a high level of selectivity. This localized action reduces the likelihood of generalized toxicity or side effects, common in immunosuppressive drugs.

With respect to companies developing DACs and other protein degraders, Beacon is currently tracking 951 companies that are involved in the development of protein degraders. Of these, 395 are developing PROTACs, 263 are developing molecule glues, and 79 are developing DACs.

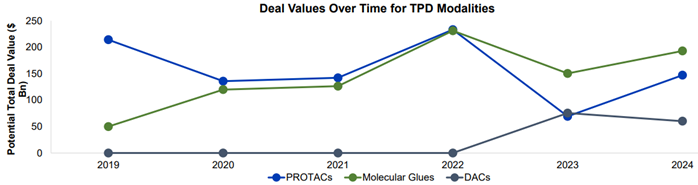

The DAC field is in its infancy compared to more established TPD modalities, as highlighted in the graph below, which demonstrates the investment in these three modalities over the past five years.

DAC investments peaked in 2023 attributed to Nurix and Seagen’s partnership and collaboration to develop a portfolio of DACs against cancer.

February 2025: Molecular Glue Deals in the last 12 months

As JPM 2024 wanes and momentum for deals that will break at JPM 2025 starts, here’s the summary of the biggest deals in molecular glue degraders (MGDs) in 2024.

- $1.5bn: Biogen and Neomorph announced a multi-target research collaboration to discover and develop MGDs for Alzheimer’s, rare and immunological diseases

- $1.5bn: Neomorph entered into a collaboration and licensing agreement with Novo Nordisk to discover, develop, and commercialize MGDs

- $1.5bn: SEED Therapeutics entered strategic research collaboration with Eisai to discover and develop novel MGDs

- $1.5bn: TRIANA Biomedicines and Pfizer entered a strategic collaboration and option to license agreement to discover novel MGDs

- $2.3bn: Monte Rosa Therapeutics announced a global licensing agreement with Novartis to advance T & B cell-modulating VAV1-directd MGDs

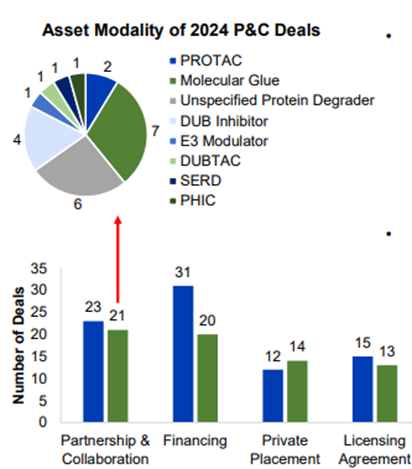

Despite 3 of the above licensing agreements, partnerships and collaborations were the most common deal type in 2024 (21 compared to 23 in 2023).

Of these, 7 were molecular glues, 70% involved protein degrader assets but there was an increase in DUB inhibitors and protein proximity inducers including Photys’ collaboration with Novo Nordisk.

January 2025: 2024 Trial Landscape Summary

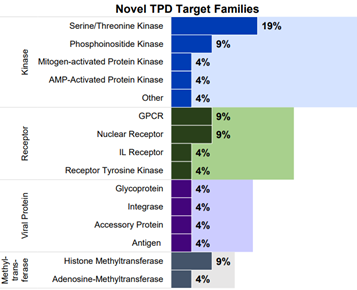

Since January 2024, Beacon reports that 13% of new assets are against a novel target.

Kinases are the most frequent novel target, mirroring the trend seen for 2023. The majority of kinases were serine/threonine kinases.

Viral proteins account for 8% of the novel targets in 2024, including VIF (viral infectivity factor) an accessory protein found in HIV and other lentiviruses. This reflects the increasing interest in utilizing TPD strategies to selectively degrade viral proteins within infected cells.

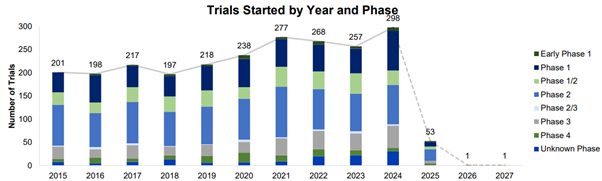

Beacon TPD currently tracks 3297 trials, a 12% increase since January 2023. The graph below shows the number of trials by start year and phase since 2015. The dotted line shows the number of trials forecasted to start in 2025 onwards.

In 2024 the TPD space saw the largest number of trial initiations to date, with an average annual growth rate of 8% from 2015 to 2024. Phase 1 and 2 trials accounted for most trial initiations, with 86 and 85 trials, respectively.

Beacon TPD currently tracks 3297 trials, a 12% increase since January 2023. The graph below shows the number of trials by start year and phase since 2015. The dotted line shows the number of trials forecasted to start in 2025 onwards.

In 2024 the TPD space saw the largest number of trial initiations to date, with an average annual growth rate of 8% from 2015 to 2024. Phase 1 and 2 trials accounted for most trial initiations, with 86 and 85 trials, respectively.

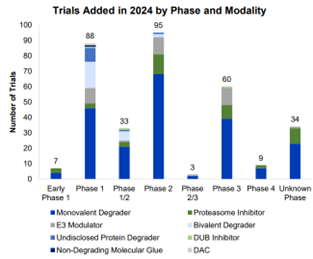

Of the trials added to Beacon TPD in 2024, 64% involved monovalent degraders, continuing the trend from previous years and mirroring the deal momentum seen.

Prioritizing early identification of promising degrader and non-degrader TPD drug candidates by assessing safety, dosing, and efficacy is seen with most trials being in phase 1 or 2.

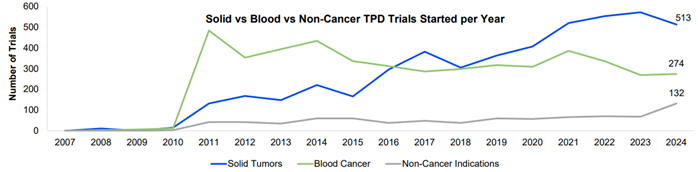

Oncology continues to be the most studied area in TPD, with 56% and 30% of the trials initiated in 2024 investigating solid and haematological cancers, respectively. While both decreased compared to initiations in 2023, breast cancer and lymphoma remained the leading indications for solid tumor and blood cancer trial initiations.

A 94% increase in trial initiations for non-cancer indications was observed from 2023 to 2024. Immune mediated diseases was the most common indication, with 23 trials initiated in 2024, followed by 19 trials being initiated for metabolic disorders. Both indications experienced downward trends until 2024 despite having been amongst the top ten indications for non-oncology drugs. A similar trend could be expected for neurological disorders next year, for which 12 trials were initiated in 2024.

DEALMAKING OVERVIEW

What has Recent Deal-Making Looked like?

The last 12 months have seen multiple large pharma partnering with biotech to leverage protein homeostasis technologies; molecular glues specifically representing a promising translational opportunity to drug the undruggable.

Novartis and Monte Rosa Therapeutics announced their licensing agreement of phase 1 orally bioavailable asset MRT-6160, Novartis agreeing to advance clinical development in immune-mediated conditions. This deal goes towards the validation of Monte Rosa’s QuEEN discovery engine to design and develop highly selective molecular glues for undruggable targets

Pfizer and Triana announced a strategic collaboration and licensing agreement for Triana’s MGD and E3-ligase pairing platform to identify new MGDs against more targets. Pfizer can pursue further preclinical and clinical development using the platform; Triana receives upfront and milestone payments

Eisai and SEED Therapeutics announced strategic research collaboration where SEED will undertake preclinical discovery activities for selected targets including identification of MGDs, and Eisai will have exclusive rights to develop and commercialise resulting compounds

Novo Nordisk and Neomorph shared licensing pact in which Novo Nordisk will discover, develop and commercialise molecular glue degraders with Neomorph in return for Neomorph’s proprietary glue discovery platform

Takeda and Degron announced a collaboration deal where Degron’s GlueXplorer platform will be used to find new glues for therapeutic targets selected by Takeda. Degron will conduct early work before Takeda takes over

Merck and C4 Therapeutics shared collaboration to develop DACs directed to undisclosed oncology target

Vertex and Orum announced Orum had granted Vertex the rights to use their technology platform to discover and develop DACs

Why do Biotech want to Collaborate with Pharma?

- Improving understanding pharma’s targets of interest, to refine fit and differentiation within the market

- Increasing big pharma’s awareness of drug discovery technology capabilities

- Validating technology platforms as working in the way intended to within the drug development process

- Gaining access to non-dilutive capital to increase the cash flow runway

- Increase translational efficiency from shared resources and risk

What do Pharma Gain from in-Licensing from Biotech?

- Expanding target discovery by unlocking undruggable targets not reachable by small molecule inhibitors, facilitating therapeutic effect through protein-protein interactions brought about by induced proximity

- Molecule Glue Degraders are easily delivered orally, designed, administered, and manufactured

- Promising opportunity for catalytic therapeutic effect with potentially more favorable dosing versus typical small molecule inhibitors which must be repeatedly dosed for maintained therapeutic effect

- Increasing specificity and selectivity to reduce off-target effects and improve safety profiles